An analysis based on exclusive data, conducted by the think tank The Shift Project, suggests that most of current oil supply sources to the European Union may decline by 2030. One more reason for ambitious decarbonation policies.

- Download our study: The European Union can expect to suffer oil depletion by 2030 – a prudential prospective analysis (The Shift Project, 2020)

- Join our videoconference on Thursday 25th of June 6:30pm (in French): register, discover the program and connect on Zoom or Facebook Live

From 2019 to 2030, the total volume produced by the EU’s current oil providers is likely to shrink by up to nearly 8%

The likely decline, by 2030, in the production capacity of those countries that currently supply more than half of the oil consumed by the European Union (EU) could lead to severe constraints on EU supplies.

The likely decline, by 2030, in the production capacity of those countries that currently supply more than half of the oil consumed by the European Union (EU) could lead to severe constraints on EU supplies.

From 2019 to 2030, the total volume produced by the EU’s current oil providers is likely to shrink by up to nearly 8%, according to an analysis featuring a level of detail unavailable sofar in any public study; the report is mostly based on estimates of future global crude oil production capacity provided by a Norwegian market intelligence agency, Rystad Energy.

The highest potential rates of this decline would exceed the decline rate of oil consumption in the European Union since 2010 (notwithstanding, the EU currently imports more crude oil than China or the United States).

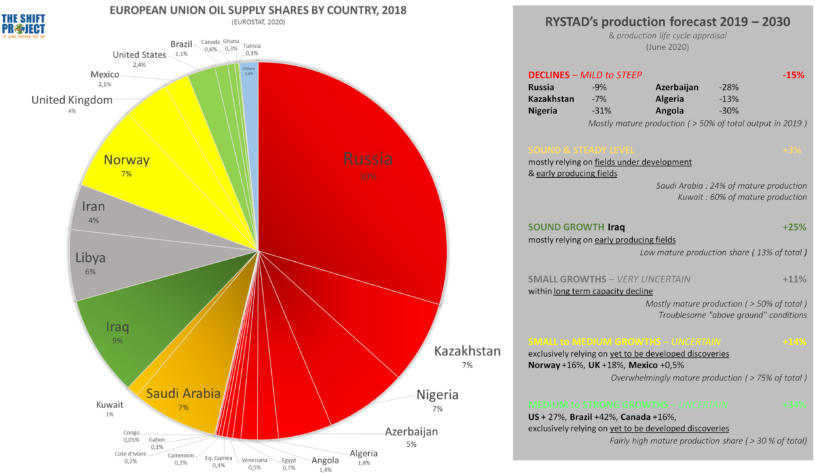

A declining production for Russia, former USSR countries and Africa, which represent 50% of EU’s oil supply

The combined production of Russia and all former USSR countries, which together account for more than 40% of the EU’s oil supply, seems to have entered a systematic decline in 2019. Africa’s oil production (more than 10% of EU supplies) appears set to decline at least until 2030.

The production growth expected by Rystad is highly dependent on the development of new oil prospects whose technical and economic potential remains to be assessed, or on hypothetical future discoveries. As a result, a significant share of the expected growth trends is more uncertain than the expected decline, which is induced by the well-known and precisely measured evolution of existing “mature” production.

Extreme price volatility and strong demand growth in Asia increase supply risk

Two factors increase this risk concerning future EU supplies:

- firstly, the extreme volatility of crude oil prices observed during the last decade, which makes investing in oil projects more complex and more risky,

- secondly, the strong growth in demand expected from Asia and Africa, while the production of both continents should decline, according to Rystad and the International Energy Agency.

While severe constraints on global oil production are likely to affect directly or indirectly the EU over the coming decade, such shrinkage seems unavoidable beyond 2030.

Global warming and “peak oil” are in no way exclusive: here are two natural hazards that pile up on each other

This challenge of limited global oil resources may be viewed as the “broom wagon” of environmental policies: if climate policies fail to be implemented at the right pace, then we will all be swept by the “broom wagon” of the decreasing availabilty of crude.

However, such constraints will not allow us to thwart global warming. Global warming and “peak oil” are in no way exclusive: here are two natural hazards that pile up on each other.

Giving “peak oil” the attention it deserves

As a result, peak oil is an additional compelling reason for designing a world without oil, and stop relying on global economic growth, which remains so far largely correlated with oil consumption.

“Peak oil” is a major yet largely undocumented issue that has not yet received the attention it deserves.

Contact: petrole@theshiftproject.org | 06 95 10 81 91

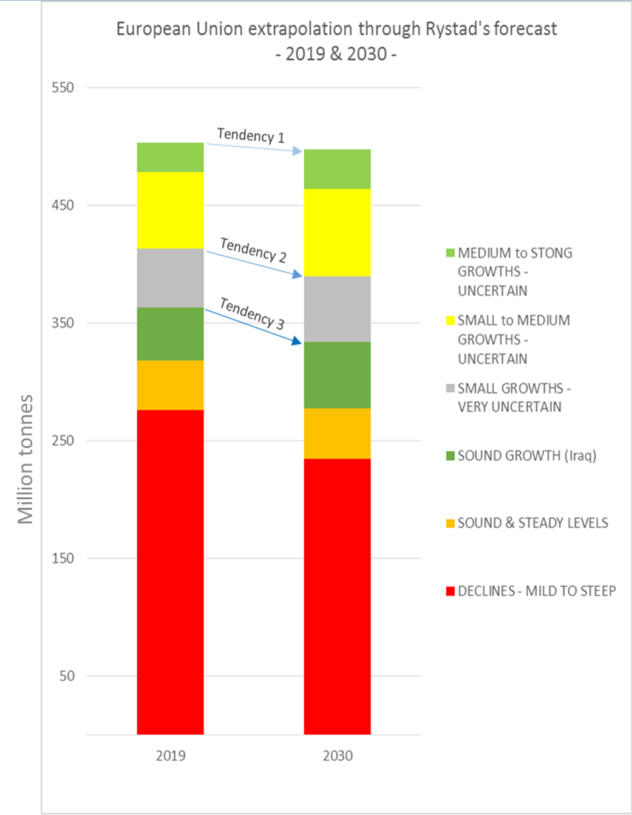

This figure summarizes the extrapolation, over the 2019 – 2030 period, of the future production profiles of the main EU supplier countries expected by Rystad Energy, classified along the categories presented in the previous section, based on the weight of each country in EU supplies in 2018. It shows that more than half of the EU’s supply sources in 2018 are expected to experience a production decline between 2019 and 2030.

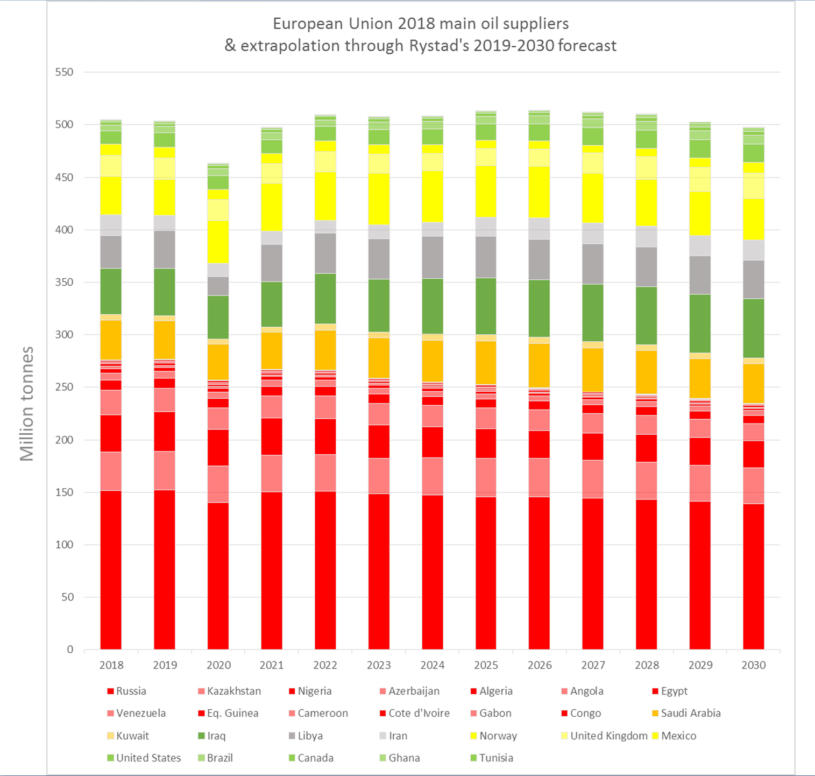

This fugure details the year-by-year evolution of the production profiles of each of the main EU supplier countries, weighted on the basis of their contribution to supply in 2018.

This figure summarizes this evolution for the years 2019 and 2030 only and by categories of analysis. It shows three slopes of trend development between 2019 and 2030 for EU’s main sources of supply in 2018, other things being equal: Trend 1 – slope of decline if all Rystad Energy’s predictions come true; Trend 2 – slope of decline if uncertain growth trends are neutralized (null growth in output of all countries in these two categories); Trend 3 – slope of decline if all uncertain and highly uncertain growth trends are neutralized.