Article published in « INSTITUTIONNELS » n°67 – La lettre d’information trimestrielle de l’association de investisseurs institutionnels »- pages 15-19 – Octobre 2022 with some additional charts. The author Michel Lepetit would like to thank the AF2I team, and in particular H. Rodarie, for encouraging me to finalize this article and for publishing it – and members of the Shifters Vincent, Marc, Etienne, Clara, Hendrika, Erik, Rodrigue, Anthony and François for the translation.

Faced with the unexpected return of inflation in many countries, the time for amazement has passed. The time for the formal accusation seems to have come, and central banks are already the target of the political, social and media world, while inflation in many countries has risen to levels unthinkable even 18 months ago[1].

The formal accusation against central banks and their economists will focus primarily on their lack of understanding – and therefore their underestimation – of the energy phenomenon. Underestimation of its geographical dimension – European but also global – of its impacts, of its duration and above all of its causes.

They will plead the unpredictability of geopolitical events, and the fact that the warmongering Russia is a major player in the world energy market. A very fragile defense, because the rise in energy prices began in the spring of 2021, a year before the second aggression of Ukraine by Russia, accompanying then the gradual return of the world economy to “normal” after the pandemic[2].

For some time, these same economists will have taken refuge behind the – hopefully transitory – disruption of the global logistical system caused by COVID-19 to explain the – hopefully transitory – burst of inflation throughout the world[3].

But the central explanation for the global return of inflation, which is the consensus explanation today, is indeed energy.

Energy and economy

Periodically, the “economic sphere”, the community of influencers which promotes “economic science”, rediscovers energy, on the occasion of a surge in prices as in 2005-2008, or even in 2015 with the brutal fall in oil prices. Here again in 2022: it is once again a matter of energy prices, of today’s rising prices, and therefore of the return of high inflation, as in the 1970s (Lepetit 2021)[4].

The first big mistake made by this forgetful community, the backdrop of the misunderstanding, is the centrality of energy in the economy, its key role, holistic, vital, systemic role[5]. It must be emphasized that, based on the observation made by the economic sphere regarding the modest share of energy in GDP (i.e., around 5%) nothing can be “scientifically” concluded on the value of energy. Because the physical observation is, in contrast, indisputable: no energy? no economy! Without this 5% of GDP, there would be almost nothing of the remaining 95%[6]. Because nothing can replace energy, and calls for voluntary sobriety, even mandatory sobriety, will probably increase at the end of 2022 in order to “replace” missing energy by non-energy-consumption. Under resource constraints, energy sobriety has thus become the leitmotif of political discourse, in France and in Europe.

Energy is not substitutable, because it is the “blood” of the economy, of economic and social organization, and of all our institutions. The constant energy progress of medieval Western Europe; then the energetic supremacy of Renaissance Europe which, powerful and intoxicated by this power, set out to conquer the world, clearly preparing the energetic exuberance which seized Europe – then the world – with the Industrial Revolution in the 19th century[7].

Not only is energy not substitutable, but the substitutability between fossil fuels (i.e., 80% of global primary energy) is quite low. It does exist for example for the production of electricity: substitution, envisaged during the Suez Canal crisis in 1956, actually implemented after the crisis of the Yom Kippur War in 1973, should again experience a certain “success” with the expected return of coal to thermal power stations in Europe after 2022. But this short-term substitutability between energies is limited when it comes to more widespread uses such as individual heating, and even more limited for transport: for mobility, oil remains the queen energy with a virtual monopoly (95%) on the billion internal combustion engines that transport people and goods around the world.

Investments and energy

This low substitutability between petrol, gas and coal is materialized through the titanic infrastructures used to extract, produce, convey, and process those energies. The 2022 geopolitical events forced us to rediscover the key role of gas infrastructure, where investments are measured in billions of dollars and the timescale is thirty years or more.

Hence, it is also rediscovered that natural gas procurement contracts are most often long term or even very long term.

The hope that some economists put on liquefied natural gas spot market is partly illusory, as it represents less than 20% of the total world market for gas; gas being mainly delivered through pipelines requiring heavy and costly infrastructures. Because natural gas is volatile and dangerous.

The worldwide investment in the energy system is about 2,000 billion dollars a year. Roughly half of this is allocated to electrical systems, the other half is used for hydrocarbons[8], particularly for their extraction. While electricity prices are soaring in Europe, and possible power cuts are planned, one can anticipate a growing debate in France and in our neighboring countries about the required human and financial resources to support the effective relaunch of nuclear programs[9].

Central bankers and energy

Central banks and their legions of economists made two serious mistakes as they evaluated and modeled the energy issue. The first one concerns the price signal relevance on energy futures markets, and this blunder will not be forgiven: while assessing the inflationary risk, the great money men have displayed an unfounded belief in the market’s capacity to give a relevant indication on the future prices of oil.

Should they insist that their peers have erred too, their rhetoric would be feeble. And it may not satisfy a political world which is seeking scapegoats to justify taking over the governance of “independent” central banks.

The second serious mistake could be the lack of a relevant macroeconomic interpretation to explain the low inflation period from 2010 to 2020. During this decade, central banks were unable to reach their 2% inflation target because of deflationary pressures. At the same time, they were unable to reach consensus on reasons behind this strange macroeconomic phenomenon, fueling doubts and discrediting themselves. According to monetary theory followers, the massive creation of money due to accommodative measures put into place by the Fed and the ECB should have created inflation instead.

The great money men may have underestimated the deflationary nature of the extraordinary monetary policy instituted by the Fed following the 2008 global financial crisis. Never mind! Although frequently too low, inflation was under control. They were proud of this achievement, without quite understanding its cause[10].

-

Energy, inflation, and price signal: mea maxima culpa

All central banks have been confronted with the increasing energy prices since spring 2021, with the gradual emergence of the economic collapse brought on by the pandemic. All were wrong about the future evolution of energy prices, based on their assumptions on prices in the energy futures market.

A recent study of the economic services of the ECB[11], hardly noticed by anyone, should be carefully read: “Recent mistakes in inflation forecasts?” This interrogative form could have been adequately completed by “the energy explanation”!

The article is an extraordinary mea culpa, a confession of dereliction and collective incompetence for the ECB economists. But even beyond that, for the “economic sphere” feeding the modeling works of the central banks….

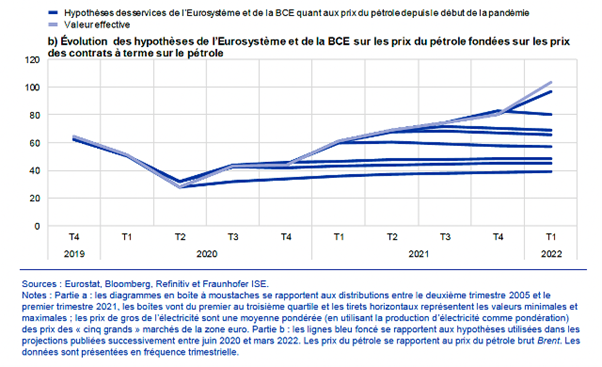

“(…) Recent projections by Eurosystem and ECB staff have substantially underestimated the surge in inflation, largely due to exceptional developments such as unprecedented energy price dynamics and supply bottlenecks. Although headline HICP inflation projections for 2020 were fairly accurate despite the emergence of the coronavirus (COVID-19) pandemic, some underestimation began to occur in the first quarter of 2021, and this has become more pronounced since the third quarter of 2021. (…).”

“(…) In Eurosystem and ECB staff projections, assumptions for energy commodity prices are set according to market-based futures, which is common practice across central banks and international institutions. The exceptional increase in energy prices was largely unanticipated by market participants (…).”

Evolution of the Eurosystem/ECB staff assumptions for oil prices since the start of the pandemic

Graph extracted from the Economic Bulletin of the ECB – April 2022

“(…) Errors in the conditioning assumptions, particularly for energy prices, explain about three-quarters of the recent Eurosystem and ECB staff projection errors for inflation, on average (…). As mentioned above, these projections are, by design, conditional on a set of assumptions for commodity prices as well as on exchange rates and interest rates that, in most cases, originate from financial market data. Oil price assumption errors have been the most regular and prominent contributor to inflation errors (…).”

This appeal to the futures market for macroeconomic previsions is often visible – and sometimes implied – at the IMF, the Fed, the ECB, at the Bank of England, the Bank of Canada, the National Swiss Bank … with sometimes unfortunate variations in their models[12].

An analysis of the Bank of England[13] explains with lucidity the intrinsic weakness of such a market indicator for modeling and anticipating the future energy prices:

An analysis of the Bank of England[13] explains with lucidity the intrinsic weakness of such a market indicator for modeling and anticipating the future energy prices:

“(…) oil spot and futures prices will always be tied by an arbitrage relationship, which, in practice, means that the futures curve has been relatively flat compared to the scale of price moves seen over the past few years. (…).”

Euphemism! By construction and by this possibility of “physical” arbitration permitted by the futures market, futures prices are (1) close to the spot price and (2) for 2-year contracts, close to the prices for 1-year contracts. Not only does the market minimize the volatility of prices for 1-year contracts, but it can lead one to believe that the anticipated fluctuations of the oil price will subside.

Therefore, I. Schnabel, member of the Directory of the ECB, in charge of research, has been led to explain learnedly – and rather awkwardly – in January 2022[14] that:

“(…) In our baseline scenario, the current energy shock is expected to fade over the projection horizon. The Eurosystem staff projections are based on gas and oil futures prices, which suggest that energy prices should decline measurably this year, thereby significantly contributing to the projected decline in HICP headline inflation over the medium term (…).“

Letter addressed by The Shift Project VP Michel Lepetit to Esther L. George (President and CEO of the Federal Reserve Bank of Kansas City, Texas) and Robert S. Kaplan (President and CEO of the Federal Reserve Bank of Dallas), questions the assumptions behind monetary policy’s so called ‘neutrality’.

-

QE and energy deflation: Qapital Endiscipline

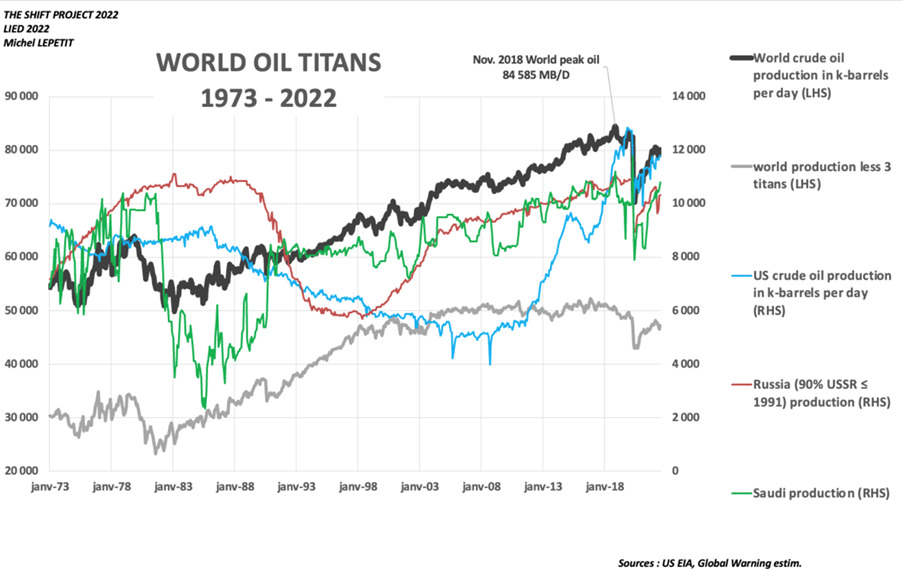

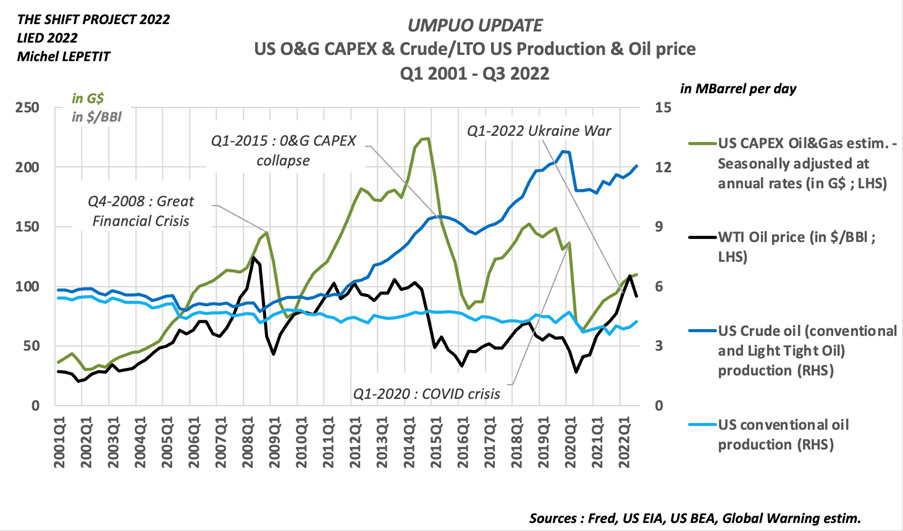

If we observe that the question of oil price has (re)become central since the end of the great confinement following COVID, we can legitimately ask ourselves why the same thing did not happen in recent history. Within her recent communications, the economist Isabel Schnabel provided information that can lead to an explanation. Following a first speech in April 2022[15], she pertinently characterized the origin of the deflationary pressure on the price of energy during the decade of the 2010s:

“(…) In the wake of the “shale oil revolution”, the United States significantly increased its production of oil and natural gas, gradually pushing up supply and putting persistent downward pressure on global oil prices. (…)”

In a more recent speech[16], the former academic Isabel Schnabel refined her argument, all the while showing commendable humility:

« (…) Yet, monetary policy was not the only factor behind the Great Moderation. Good luck, in the sense of a smaller variance of the shocks hitting the global economy, is widely believed to have played an important role as well. Compared with the 1970s, for example, real oil prices traded in a much narrower range from the second half of the 1980s until the mid-2000s.

(…) The pandemic and the war are likely to add to instability in the years to come. They challenge two of the fundamental stabilising forces that have contributed to the decline in volatility during the Great Moderation: globalisation and an elastic energy supply. (…) The second stabilising force – an elastic energy supply – will also become less powerful in absorbing shocks in the years to come.

Following the oil price shocks of the 1970s, the distribution of global oil supply changed drastically. (…) The “Shale Revolution” in the United States, which started at the turn of the century, changed the oil market once again. It is estimated to have resulted in a significant increase in the price elasticity of oil and gas supply. As a result, just as globalisation led to excess supply in product and labour markets, limiting price and wage increases, the emergence of the United States as a large net exporter of energy buffered the impact of demand shocks on oil and gas prices over the past 15 years. (…)”

It appears, therefore, that the irruption – totally unthought of before 2008 – of the US shale oil “revolution” (some say “miracle”) on the world stage would have prevented any global surge in energy driven inflation. In fact, this exuberant shale oil production even became deflationary in 2015, contributing to the collapse of global oil prices[17].

I hypothesized (Lepetit 2020)[18], corroborated in part by other analysts (Stroebel 2020 ; Artus 2021)[19], that it was US monetary policy itself that has significantly contributed to this oversupply of unprofitable investments in gas and American shale oil for a decade.

Since the collapse of oil prices starting in 2020 as a result of a strong contraction of global demand for oil, the great consumer of capital that is the US oil industry, but above all investors that supported it, seemed to have been converted to a more “rational” and less “exuberant” investment policy.

The time for “capital discipline,” so dear to this industry, has returned, where the volume of investments fluctuates again coordinated with the evolution of global oil prices, without henceforth being impacted by the successive waves of money creation from the Quantitative Easing as in the 2010’s.

US Investments in hydrocarbons (2001-2022)

Conclusions

Several research programs at the IMF (Furceri 2016; Furceri 2017)[20] and the World Bank (Ha 2019)[21] remind us of the major role of energy in the 2010s both systemic[22] and holistic, in explaining certain major inflationary and deflationary phenomena over the long term. But central bankers, who sometimes think they control destiny, could not be satisfied with such subservience to the “physical” world[23].

The two misjudgments of the link between energy and inflation outlined above reflect a fundamental misunderstanding of the energy issue by “economic science” and a misunderstanding of the essential physical role of energy in the workings of the economy[24]. In both cases, “economic science” is tempted to clumsily apply to energy some concepts – such as the law of supply and demand through the price signal – that are more relevant to describe ordinary markets such as wool or pencils[25].

In a world where the American shale oil “miracle” would not be repeated, inflationary pressure via oil prices could become structural. Only the rise in oil prices would indeed make it possible to trigger the investments likely to satisfy an ever-increasing world energy demand, outside of epidemics, war, economic recession, or the global awareness of the climate imperative. Faced with this constrained supply, oil demand is known to show very little elasticity to price signals, as the social phenomenon of the “yellow vests” demonstrated in France once again in 2018.

In the current context, where energy is at last the focal point, some academic works, and statements by economists, some of whom have become influential central bankers, suggest that the energy-climate issue could finally be revisited by abandoning some of the illusions of “economics”.

Let us hope so. There is an emergency.

Michel Lepetit, Vice-President and co-founder of The Shift Project

[1] FT – Editorial – A pivotal moment for the world’s central banks – 23/08/22 https://www.ft.com/content/0341736c-9ccf-4b7e-9977-734820e9804b It is remarkable that the article makes no substantive reference to the topic of energy…

[2] Note that the World Bank’s annual report for 2021 (WorldBank Global Economic Report – January 2022) contains 298 times “oil”; 194 times “energy” and 322 times “inflation”.

[3] The phenomenon is real, and reminds the historian of other logistical disruptions: that of the Suez crisis in 1956-57 when Europe set up oil rationing mechanisms, following the logistical disruptions due to the closure of the Suez Canal and the sabotage of Middle Eastern oil pipelines; that of 1970-71, prelude to the great oil crisis of 1973, which saw oil prices escalate due to the cost of oil freight, induced by production restrictions in Libya and by the sabotage – again – of a Middle Eastern oil pipeline (“Tapline”)

[4] Lepetit M. (2021) – Chapter II : Inflation, Vietnam and Oil in the 1970s – 29/10/2021

[5] Some economists are nevertheless beginning to understand the central and systemic role of energy, and in particular the immense socio-economic transformations that the transition to a low-carbon economy and society implies … if we really want to face the challenge of anthropogenic climate change.

[6] From this point of view, the observation sometimes made in certain economic studies of the downward trend in the “energy content of GDP” further adds to the confusion.

[7] This was initiated in England earlier than is often said, in the 15th century, with the massive use of domestic coal in London. (Wrigley E.A. (2016) – The Path to Sustained Growth – England’s Transition from an Organic Economy to an Industrial Revolution– Cambridge University Press – 2016)

[8] See IEA World Investment report 2022

[9] It should be noted that the low-carbon transition plan for France, designed and successfully promoted by the think-tank The Shift Project, makes no reference to the issue of prices (The Shift Project (2022) – Plan de transformation de l’économie française – Odile Jacob – 2022)

[10] Attempts at explanation by some economists have been remarkably diverse: from the advent of digital technology; to the theory of great economic cycles; to “secular stagnation”; to demography; and even to multi secular history…

[11] Chahad M. & Als (2022) – What explains recent errors in the inflation projections of Eurosystem and ECB staff ? – Published as part of the ECB Economic Bulletin, Issue 3/2022.

[12] We will not propose here a critical analysis of the unsuccessful attempts to improve (by the Bank of Canada; by the ECB; by the Bank of England) such a crude model, and which would not satisfy any rational and somewhat curious mind about energy. Let us quote:

– the Bank of England model, with a fixed forward price ((BOE 2019) – Bank of England – Monetary Policy Report – August 2019) ;

– the various ECB models, very elaborate as of 2016 ((ECB 2015) – ECB Economic Bulletin, Forecasting the price of oil – N° 4, 2015 ) redesigned and finally abandoned at the end of 2021. The first doubts about the validity of the ECB’s latest model were expressed in October 2021, in the minutes of the monthly meeting : « (…) Related to this, doubts were expressed about the use of typically downward-sloping oil price futures curves as projection assumptions, when fossil fuel prices were bound to remain elevated or rise further. (…) »

[13] Bank of England (2012) – What can the oil futures curve tell us about the outlook for oil prices?’- Quarterly Bulletin, Q1 2012

[14] Schnabel I. (2022 a) – Looking through higher energy prices? Monetary policy and the green transition – Frankfurt am Main- 8 January 2022

[15] Schnabel I. (2022 b) – Managing policy trade-offs – Cernobbio – 2 April 2022.

[16] Schnabel I. (2022 c) – Monetary policy and the Great Volatility – Jackson Hole – 27 August 2022

[17] Lepetit M. (2020 a) – West Slide Story : Unconventional monetary Policy & Unconventional Oil (UMPUO 2000 – 2020) – 20/10/20

[18] Lepetit M. (2020 b) – Is monetary policy (carbon) neutral ? – The Shift Projet 26/11/20

[19] Stroebel F. & als (2020) – A Structural Investigation of Quantitative Easing – Deutsche Bundesbank Discussion Paper – 2020

Artus P. (2021) – Le retour à l’économie des années 1970 – Les Echos – 8/04/2021

[20] Furceri D. & als. (2016) – Global Disinflation in an Era of Constrained Monetary Policy – IMF WEO 2016 Chapter 3 – October 2016

[21] Ha, J. & Als. (2019) – Inflation in emerging and developing economies: evolution, drivers, and policies – World Bank Group – 2019

[22] The systemic link between energy and agriculture is increasingly well documented: fertilizers, machinery, biofuels…

[23] On the contrary, some economists have preferred to rewrite history by making the energy issue at the heart of the “Great Inflation” of the 1970s almost disappear, transforming it into a purely monetary phenomenon. (See: Lepetit M. (2021) – Chapter II : Inflation, Vietnam and Oil in the 1970s – 29/10/2021)

[24] The reader is directed to the fundamental works of Jean-Baptiste Say, and even of Adam Smith, which sometimes – but rarely – mention the energy question.

[25] See the first chapter of: Friedmann M. & R. (1980) -Free to Choose – Harcourt – 1980