The Economist cette semaine (september 24th-30th 2011) reprend certaines idées qui inspirent The Shift Project :

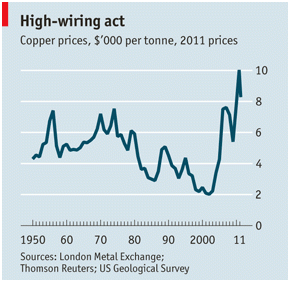

1) Dans son dossier central « Special report on The World Economy», on trouve le chapitre à lire « Commodities : Crowded out » (page 20 ; article) où on peut lire après le graphique suivant qui illustre la remontée récente des cours des matières premières par rapport à la longue durée (1845 – 2011) :

« (…) This has raised the incomes of commodity-rich countries such as Brazil and Australia as well as parts of Africa. It has also caused even sober analysts to speak of a “new paradigm” in commodity markets. Even though GDP has slowed to a near-standstill in many parts of the rich world, the price of crude oil is close to $100 a barrel—as high in real terms as after the oil shocks of the 1970s «

(…)

« Brazil’s offshore oil will be expensive and difficult to recover. If this is what the world is relying on, say the pessimists, the shortage of oil is truly critical. They argue that the resource limits to growth first noted by Thomas Malthus in the late 18th century still apply. Optimists bet on human ingenuity to spring the Malthusian trap, as it has done so often before. (…) »

Cet article fait écho au récent plaidoyer de D. Yergin (Chairman of IHS CERA) en double pages centrales du Wall Street journal (17/09/11): « There will be Oil » (article) :

« (…) Meeting future demand will require innovation, investment and the development of more challenging resources. A major reason for continuing growth in petroleum supplies is that oil previously regarded as inaccessible or uneconomical is now part of the mix, such as the « presalt » resources off the coast of Brazil, the vast oil sands of Canada, and the oil locked in shale and other rocks in the U.S. »

(…)

« Things don’t stand still in the energy industry. With the passage of time, unconventional sources of oil, in all their variety, become a familiar part of the world’s petroleum supply. They help to explain why the plateau continues to recede into the horizon—and why, on a global view, Hubbert’s Peak is still not in sight. »

Il est intéressant de mettre ces articles en rapport avec l’éditorial récent (9/09/11) du Wall Street Journal adressé au gouvernement britannique, thèse symptomatique des difficultés politiques actuelles et à venir au Royaume-Uni et ailleurs : « Osborne’s Faulty Compass – The British Chancellor seems to have lost the way to growth.” (article) où l’on peut lire :

« (…) Meanwhile, all consumers and businesses are paying more than they need to for their electricity, thanks to the government’s requirements that electricity suppliers source ever more of their electricity from « renewable » sources such as wind power, which remain less efficient and more expensive than fossil fuels.

(…)

Mr. Osborne said on Tuesday that « we need to take pro-growth decisions just as difficult as the decisions we have taken to tackle our deficit. » But the biggest decision he could make would be an easy one. If the British government would stop prioritizing its futile pursuit of that great white whale called « climate change » over the need for growth and jobs, it would put wind in the economy’s sails without costing Mr. Osborne a penny. »

Et on trouvera par ailleurs le 20/09/11 une réponse cinglante à D. Yergin dans l’excellent blog Econbrowser du professeur d’économie J. Hamilton (article), grand expert très pondéré des sujets macroéconomiques (énergie, politique monétaire …) :

« (…) In any case, I was not among those who claimed that the peak would arrive by Thanksgiving 2005, nor 2007, nor 2011. But I am among those who did claim, and still believe, that the slow rate of increase in annual oil production over the last 5 years has caused significant economic problems for countries like the United States. »

Et J. Hamiton de citer Yergin (2005) avec malice :

“There will be a large, unprecedented buildup of oil supply in the next few years. Between 2004 and 2010, capacity to produce oil (not actual production) could grow by 16 million barrels a day — from 85 million barrels per day to 101 million barrels a day — a 20 percent increase. Such growth over the next few years would relieve the current pressure on supply and demand”.

2) Toujours dans le dernier The Economist, dans la rubrique « Finance and Economics » (page 87 ; article) « Copper : Red bull », on peut lire les passages suivants sur le marché du cuivre, pour expliquer la hausse des prix des dernières années :

« (…) New copper supply is going to be increasingly dependent on smaller mines that are deeper underground and have lower ore grades. As Gayle Berry of Barclays Capital notes, these mines will also mainly be in riskier parts of the world, such as Africa’s copper belt, stretching across Zambia and Congo. The Chinese have a mine in Afghanistan. The lack of vital infrastructure such as roads, railways, power and water, and the ever-lengthening process of getting mining permits, will make the newer mines far more costly.

This bodes ill for future supply. Lead times for new projects, once four to five years, have crept up to between seven and eight years. Wringing extra copper out of existing mines has its difficulties too. Miners dig in the better parts of mines first. As older mines get deeper, ore grades decline and extraction becomes more expensive. The disruption rate (the amount of promised copper that fails to materialise), about 2% five years ago, is now as high as 8%, according to Andrew Keen of HSBC.(…) »

Article qui entre en résonnance avec un article récent du Financial Times également sur le cuivre “Red metal stays hot as miners fall short” (14/09/11 ; article)

« (…) But, according to a growing number of mining executives, traders and analysts, mine production will be lower this year than in 2010.

The reason: output is plunging at some of the world’s largest mines as they produce ore that contains increasingly little copper. Bad weather and strikes have knocked output, while new projects that miners hoped would lift global production have been delayed.(…) »

3) Encore dans le dernier The Economist, on relèvera dans la rubrique “Science and Technology” le long article (article) “Climate change in the Arctic – Beating a retreat- Arctic sea ice is melting far faster than climate models predict. Why?” dans lequel on peut lire :

« (…) That Arctic sea ice is disappearing has been known for decades. The underlying cause is believed by all but a handful of climatologists to be global warming brought about by greenhouse-gas emissions. Yet the rate the ice is vanishing confounds these climatologists’ models.

(…) The rapid melting of the Arctic sea ice, then, illuminates the difficulty of modelling the climate—but not in a way that brings much comfort to those who hope that fears about the future climate might prove exaggerated. When reality is changing faster than theory suggests it should, a certain amount of nervousness is a reasonable response.(…) »

Mais aussi :

(…) One feedback loop that does seems certain, though, is that the melting Arctic will enable the extraction of more fossil fuel, with all that that implies for greenhouse-gas emissions.

The Arctic is reckoned to hold around 15% of the world’s undiscovered oil reserves and 30% of those of natural gas. Hence a growing polar enthusiasm among energy companies—as witnessed last month in an Arctic tie-up between Exxon Mobil, of America, and Rosneft, Russia’s state-controlled oil giant. (…)

4) Enfin, last but not least, il est intéressant de regarder comment se conclut la version papier de The Economist, magazine de référence des décideurs économiques dans le monde. En fin de journal se trouve son fameux tableau de bord hebdomadaire.

Dans cette rubrique « Economic and financial indicators » page 109, le dernier indicateur fourni est …

… le prix du pétrole : « West Texas Intermediate (WTI) – $ per barrel. »

Est-ce le point final ? Pas tout à fait puisque ce tableau de bord très lu se poursuit à la page suivante, et que le dernier indicateur présenté est …

… le cours du Carbone « Carbon trading (EU ETS) € »

Signe des temps ?

Par Michel Lepetit – Trésorier de The Shift Project / Président de Global Warning